April 18, 2022 | Digital Marketing , Microsoft 365

Did you know that bank faces financial crimes and fraud? As a customer, we all know that you also became the victim of several financial frauds, scams, and risks. Various types of newest criminal topologies come into existence with advancements in financial services and technology.

For example, financial crime in banks happens by using digital technologies like identity theft, phishing, mobile banking frauds, and more.

With technological innovation, banks experience different financial fraud risks and criminal activities. Primarily, the actions utilized to extract a large amount of finance from the customers or banks by using illegal processes are called financial crimes.

Here, we present an overview of different financial fraud risks that bank experiences.

Identity theft and account takeover is a type of financial crime that bank experiences in various processes.

This type of financial crime primarily happens through phishing which involves several processes to extract secure data.

For example, a fraudster will send an email to a bank employee imitating their manager or high authority bank executive. Afterward, they demand sensitive information like database passwords or customer account details.

So, when they receive highly secure financial data, they cause severe damage and use overdraft limits and cross-credit lines. In this manner, bank experiences heavy financial loss.

This type of financial crime occurs due to mobile banking use through applications. So, it gives the necessary platform to fraudsters to manipulate highly secure financial information and transactions.

For example, in this crime, a fraudster will send messages that contain links between bank accounts and mobile portals. However, it often demands the financial credentials using that link, and when submitted, they will extract the required capital amount online from the bank account.

Moreover, there are dedicated IT solutions for banking to solve these financial crimes using the latest technologies.

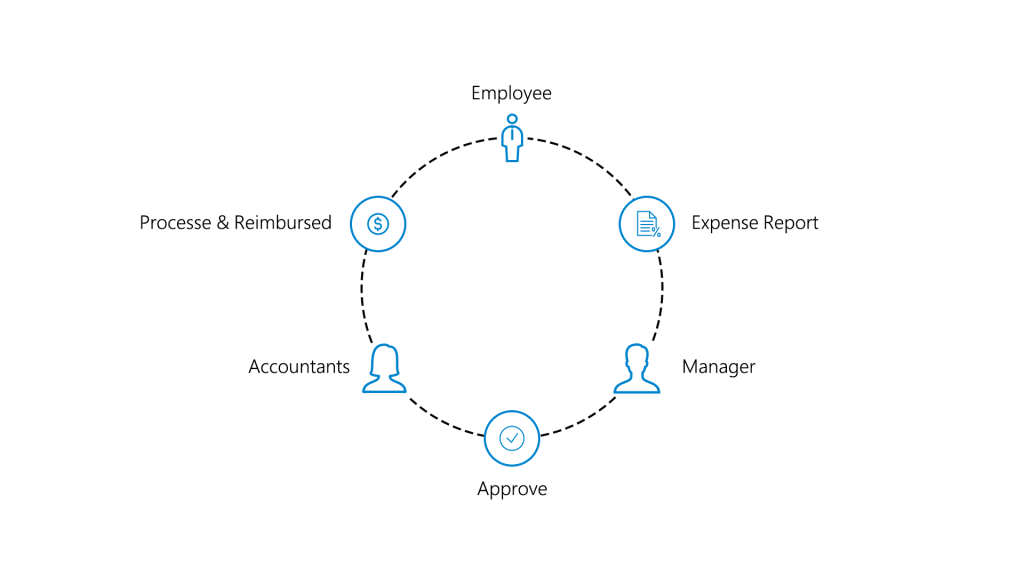

Expense fraud primarily arises from submitting increased or false expense claims for repayment by bank employees. For instance, these employee expenses occur when traveling or working on weekends.

Therefore, the bank management team and finance managers might give less attention to these low-cost employee expenses. So, they also impart less time on the authenticity and verification of these expenses.

All these small fraudulent claims will become significant financial risks with time.

Banks utilize different Microsoft 365 technology and solutions to combat financial crimes. So, have a look at those technologies.

It is one of the best IT solutions for banking to overcome and solve identity theft and mobile banking financial crimes. The banks can benefit from the Azure Sentinel feature of Microsoft 365 that can help resolve these frauds effectively.

For example, the functions of Azure Sentinel like integrating identity, mobile and web application, core banking processes, and protecting other financial data will solve both frauds. A bank can build multiple machine learning models to detect abnormal behavior and new financial crime patterns by using these security functions.

Besides, a bank can also utilize financial crime solutions and risk management solutions to avoid these frauds.

You can utilize the Microsoft 365 power platform to develop the applications like expense management systems based on your financial requirements. So, this powerful platform can be considered the dedicated IT solution for banking and help solve the expense fraud in banks.

Moreover, a bank can develop an expense management application to monitor the employee’s expenses and save extra finance. So, this expense management system will act as the latest technology empowering bank employees and it also helps in improving work performance.

There are different financial crimes that banks experience in payment transactions. So, it indirectly contributes to the loss of public trust. But, with the proper use of Microsoft 365 and Power platform technologies, a bank can solve and combat financial crimes.

For this purpose, you can contact atQor to help banks and other financial institutions fight against these financial crimes through banking technology consulting services.