June 24, 2021 | Digital Marketing, Bitscape

More than 70% of BFSI industry professionals believe that creating digital capabilities and modernizing legacy systems are top technology concerns for the industry & with the presence of such technologies, the industry can cross countless in-store payments globally.

Today the banking and finance sector cannot think to sustain without the involvement of IT services. Be it any financial analysis, Investment, Transaction, or customer service; IT tools play a key role in enhancing this industry. There is no bank or financial consultancy that can attain their business niche without IT services.

Just look at the world around you. E-commerce is shining brighter than malls and markets, and chatbot service is more convenient than talking to a customer service executive. UPI transaction is chosen over manual cash flow; Net banking is more preferable over cash deposits in the bank. In each circumstance, you can see that digital technology is soaring higher than the manual old-school business model.

Not only the financial sector but mobile applications are leveraging the complete digital transformation. IT Support for The Financial Services Industries primarily focuses on enhancing mobile applications to the greatest extent. There are Banking & Financial Software Development Companies in the USA that especially structures the promotion of mobile applications. The whole purpose is to make the banking and financial service completely digital and easily accessible for every existing and aspiring customer.

The IT Support for The Financial Services Industry has a formidable role to play when there is automation in the work environment. Technologies like artificial intelligence and machine learning keep on inducing human intelligence in machines that turn up with more productive data and better output, enhancing the company’s overall revenue generation.

Manual interaction is not possible all the time on every walk of customer service. Be it the financial consultants or the customer service executives; You have to bring the chatbots into the system to make their service available twenty-four hours of the day. Custom banking Software solution provider agencies are leaving no stone unturned in taking the customer interaction experience beyond the horizon of excellence.

Custom banking Software solution provider agencies are on their toes to integrate the easy solution in your operation and digitalize your workforce while making it safe and secure from external threats. The most prominent among them is Microsoft, whose powerhouse is brimming with exclusive technical services to customize your workflow and enhance customer satisfaction.

One of its gold partners, atQor, is known for giving clients vibrant services with customized solutions as per the business requirement. Although many firms and banks still work manually but indulging in IT support is something they cannot stay away from in the future.

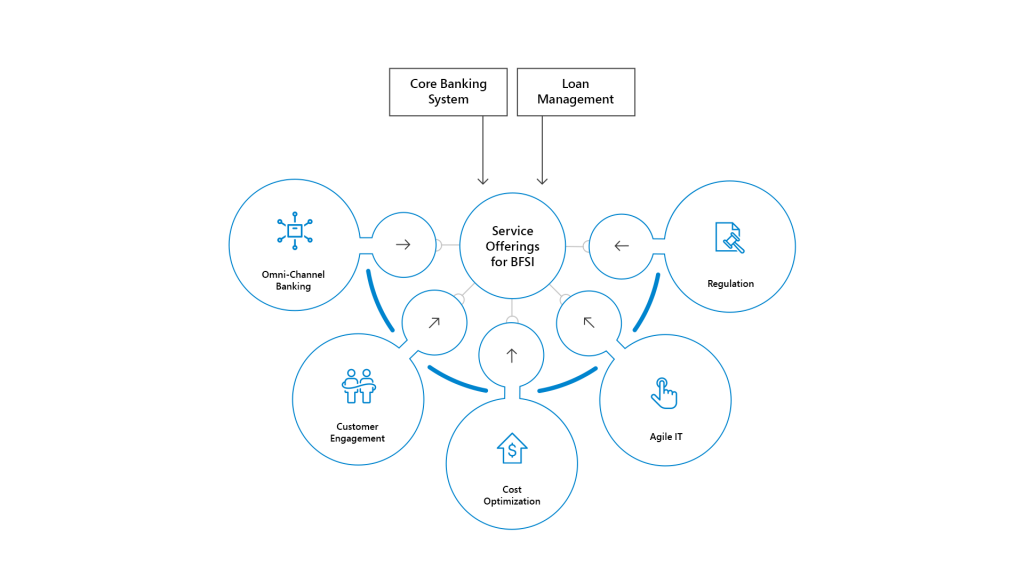

Attributable to the economic situation, financial services providers are looking for cutting-edge answers for business continuity, digital transformation, and managing long-term risk. This is the place where atQor comes in with our unrivalled involvement with conveying state-of-the-art arrangements.