April 19, 2022 | Digital Marketing , Microsoft 365

Are you looking for technology solutions to empower bank employees? In the digital era, banks are trying to find solutions that increase their employees’ productivity at work. The present scenario reveals that the employees conduct time-consuming, repetitive tasks.

For example, the task of checking and verifying the document list of the customer applying for the loan. Another process of evaluating the total collection of funds at the end of the day from various financial services. So, these tasks take more time to complete and indirectly affect the bank employees’ productivity.

Therefore, they need a solution like a centralized collaboration platform to share documents, conduct meetings and discuss innovative ideas. So, a collection of tools from Microsoft 365 solutions for banks provides the cloud collaboration platform that helps to empower banking employees and other financial services.

Microsoft 365 offers a cloud collaboration platform that offers secure collaboration, data management, sharing, and data processing on financial services. For the perfect IT solution for banking to empower their employees, they can use Azure cloud computing and collaboration platform.

Azure cloud solutions in banking are a suitable technology solution for empowering bank employees and increasing their productivity in financial services. However, this technology solution takes all the bank employees to the centralized cloud platform and allows them to work in the same working environment.

With this cloud collaboration platform, many employees can work and discuss two financial services at a time. For instance, they can verify the customer’s document list and evaluate the funds for a loan using the same platform. In this manner, the bank helps to increase the productivity of their bank employees using technology solutions.

Power BI integration into Microsoft 365 cloud platform offers different tools for data management, data visualization, creating visual dashboards, and interactive insights of necessary processes.

Hence, the bank employees can use the analytics feature and generate visual dashboards and insights into future financial events. For instance, they can create future insights into the financial market involving variable commodity pricing, foreign currencies exchange rates, and interest rates from the data stored in the cloud.

In this way, they can enrich their financial and investment decisions, make a large profit, and combat financial crimes.

In various situations and cases, bank employees require to work remotely without being available in the bank. Consider the lockdown case in 2020, where many bank employees need to work remotely.

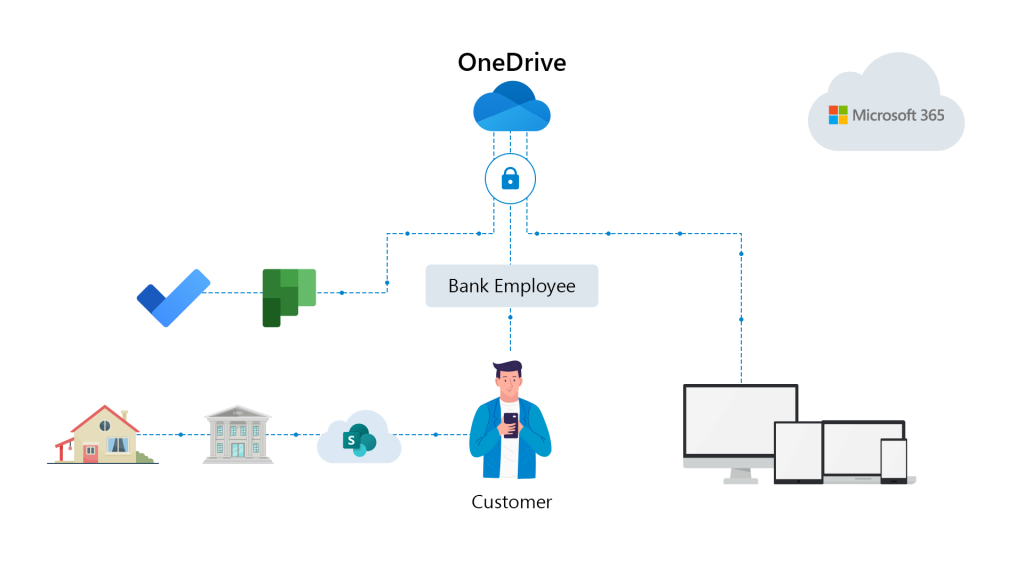

So, in that case, they have utilized social and intranet functions of Microsoft 365 cloud collaboration technology. By using SharePoint collaborative platform integration into Microsoft 365 technology, they can connect, chat, share, and manage numerous financial services.

The cloud collaboration platform from Microsoft 365 offers a cloud storage solution for securely keeping files and essential financial information. For this purpose, bank employees can use OneDrive, a cloud storage platform for securely storing files and other vital financial details of the customers.

Besides, they can access the files on multiple devices on the go and while working remotely. Therefore, this cloud storage platform also works as an effective risk management solution for the bank.

For improved performance, multiple work management features and tools like work planners, to-do lists, power apps, and power automation are available. However, bank employees use the Microsoft 365 cloud collaboration platform to schedule online meetings, draft the list, and design automated workflows of critical financial services.

Empowering bank employees through technology solutions proves to be an excellent method of converting financial organizations and banks into a productive and satisfying work environment. To increase profit and efficiency with Microsoft 365 innovative cloud collaboration platforms, contact atQor, which offers banking technology consulting services.