March 27, 2021 | Digital Marketing, Digital Solutions

The revenue system that the enterprise or company uses to invest in the source of improvement or the maintenance of long-term assets is precisely termed as CAPEX (Capital Expenditure).

It is essential to upgrade the efficiency or capability of the company. Long-term assets are usually referred to the physical, Fixed, or non-consumable assets like property, equipment, and infrastructure with a life span of more than a year.

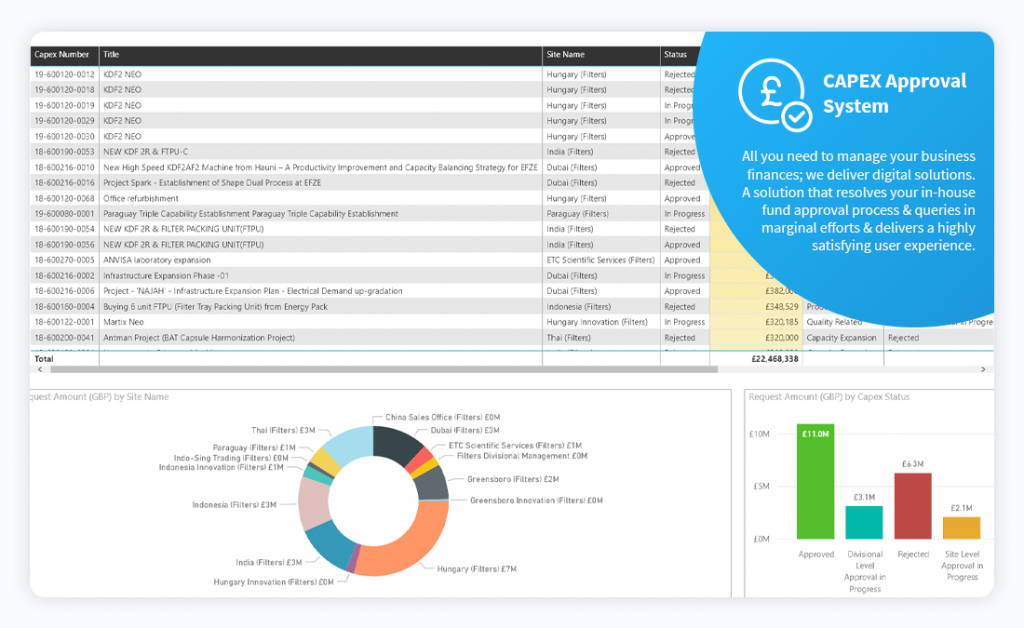

What is the CAPEX approval system all about?

Prime benefits of CAPEX approval system:

Capex approval system is very crucial for the function and conceptual growth of the company. It encapsulates the process of defining, building, and publishing the customized capital expenditure system within a concise time frame. This proves to be the reason for adopting the CAPEX approval on an extensive range, especially in the IT domain.

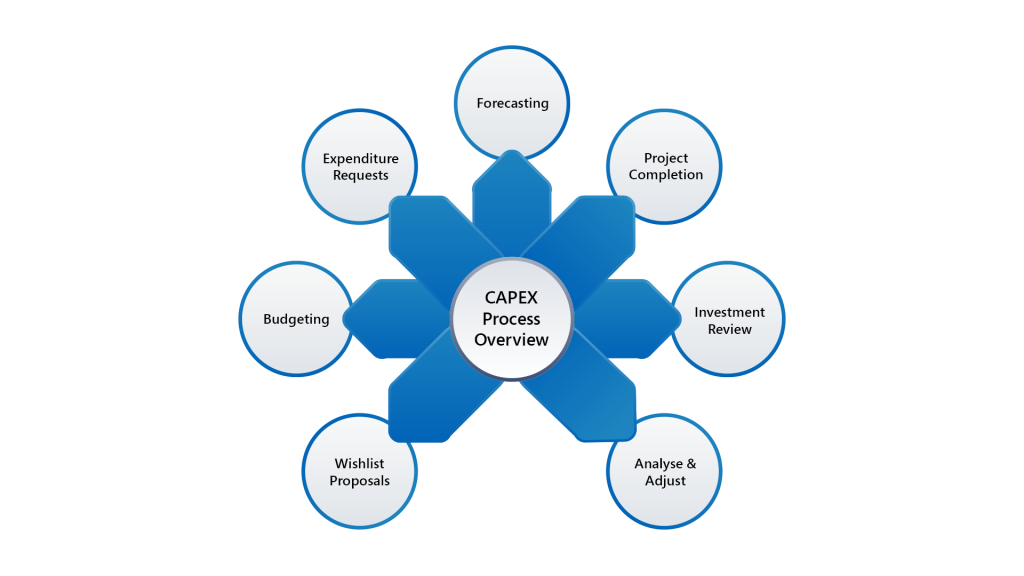

Overview of the Capital Expenditure Management (CAPEX) Process

Any organization relies on two types of expenditure:

Operational expenditure benefits are also extracted in the reporting period, while capital investments are always valuable and everlasting. Some of them are mandatory, some are autocratic yet replaced by key ingredients, and some are completely discretionary.

The organization might need to raise funds for vital capital investments by borrowing or even raising equity. The resources managing the colossal project for business requirements to deliver the productive output within a constricted time frame. Hence, there is a bright possibility that the project would demand a large supply of time and money.

Consequently, the management needs to make proper investment decisions on behalf of the owner and stakeholders. They need to ensure the fulfilment of everyone’s needs, including project sponsors, financial controllers, resource managers, and key stakeholders. Here, the customized capital expenditure request process plays the role.

It manages the flow of funds with such elegance that the investment seamlessly turns up with the productive and beneficial output.

The strategy of the enterprise determines the level of capital investment which is directly proportional to the fund allocation and budgeting. Organizations under the growth phase will allocate a greater proportion of cash flow meanwhile, the enterprises going through the recession phase will look for a restricted budget. So, management must bifurcate the investment levels on physical assets like buildings, machinery and equipment, and intangible assets like software, trademarks, and patents. This strategy-aligned proposed Capital investment program is represented by ‘the Budget.’

So, The capital budget typically contains an approved list of Capital investments categorized by:

Why to enroll for CAPEX approval solution?

The global market is constantly evolving and looking for constant growth. This requires an agile CAPEX approval software that would stay functional with the automation of hierarchy and channelise the source of investment in the correct direction. Each financial decision has to go through multiple approvals keeping safety on the back of the mind. Top investment software development companies are on their toes to give you the service and solution in the IT market.

atQor is one such enterprise that is known for its expertise in the same. The solution for a customized capital expenditure request process is a major part of its forte. atQor’s CAPEX approval system is structured to strengthen your investment at a very advanced level, whether it is a small-scale business or a large IT firm. Suppose you count on Financial Software Development Company USA. In that case, We are certainly leading the race among many of our kind that could capitalize on your investment and make it grow like anything.