December 24, 2021 | Digital Marketing, Power BI

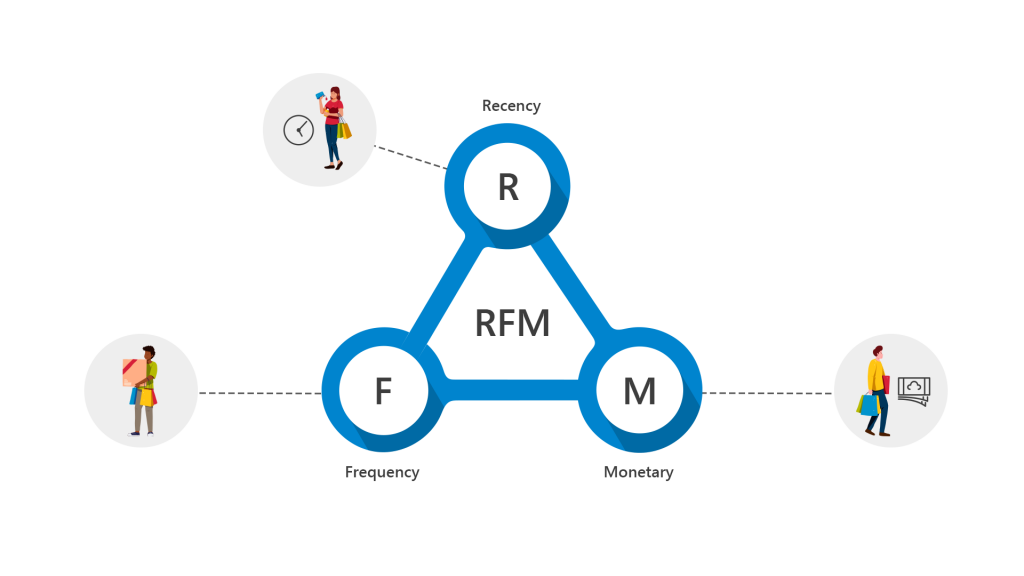

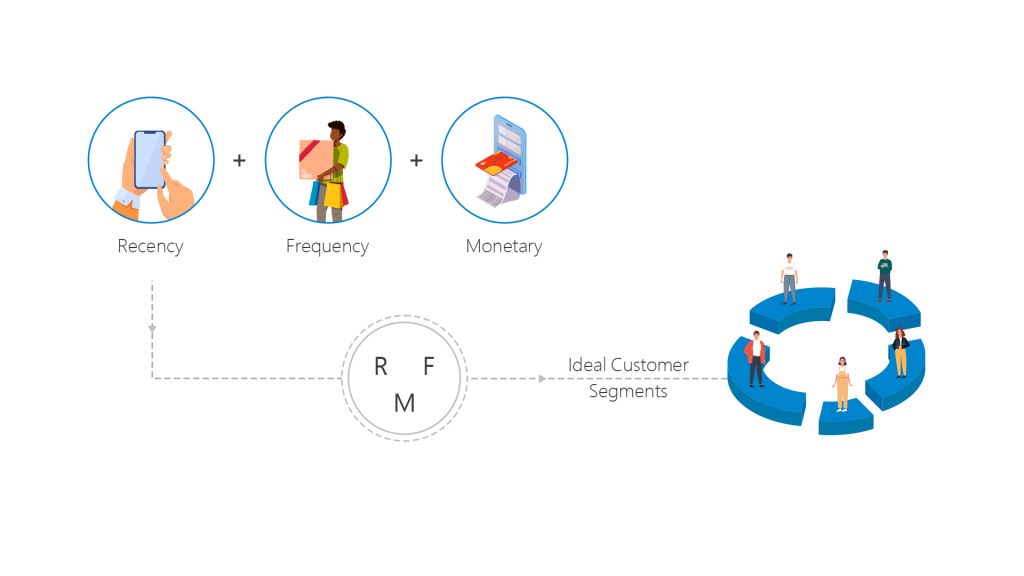

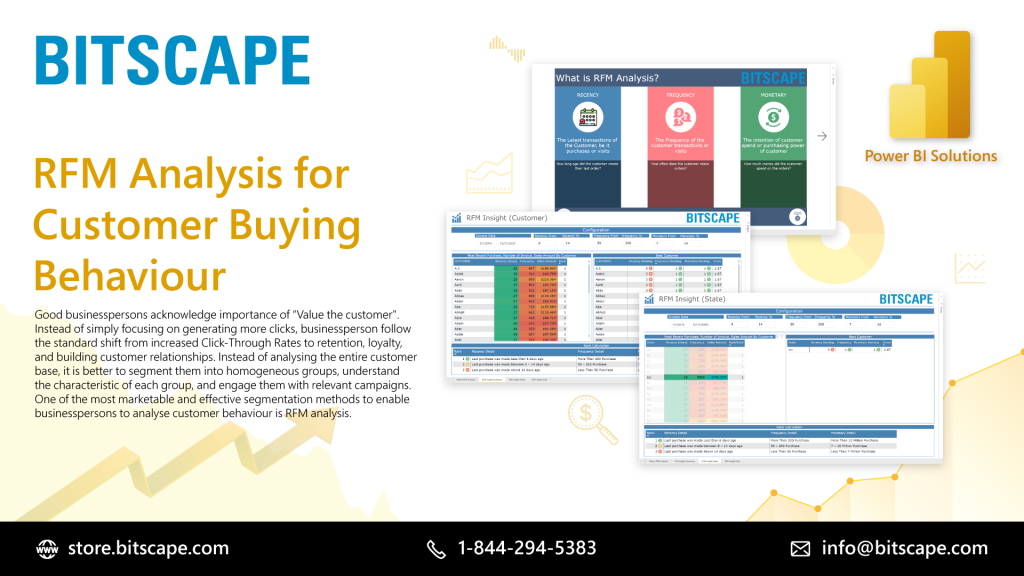

RFM stands for Recency, Frequency, Monetary. It is an excellent business practice that bifurcates the customer base on the basis of these three prospects. RFM identifies the nature of customers’ transactions, buying behaviour, and bounce back rate that enables the business pioneers to carry on target marketing and perform seasonal campaigns to enhance sale ratio, customer experience, and return of investment. To get the preciseness of customer segmentation and add value to the operational approach. The RFM analysis relies on the fact that more than 80% of the business comes from 20% of the customer base. The technology makes this premium bucket visible, which eventually facilities growth and prosperity for the firms and business enterprises.

Recency: This particularly figures out that when did the customer last made the transaction? How recent was the last purchase of the customer? The customers who have recently made the purchase exhibits more possibility to make the transaction again. The recency is often calculated in hours, days, weeks, and years. The exceptional Power BI Solution does enable the customer segmentation with a collective database, eventually leading to the sharp and streamlined growth of the business.

Frequency: This holds the calculation of how many times the customer has made the transaction within a given time frame. If the feedback of the product or service is good, The same customer base is likely to purchase the product again. Customer Segmentation Dashboard bifurcates this customer bucket, and business owners initiate the follow-up marketing to convert them into frequent buyers.

Monetary: This is the firm evaluation of the amount of money that a customer spends in a given period of time. The customer base that has spent a handsome amount of money is much likely to invest further in the same business transaction. Customer Segmentation Dashboards are an effective medium to analyse the monetary scale of a particular customer bucket. Business owners can evolve with better offers and sale variants to entertain this type of premium customers and satisfy their need to establish a better trading bridge.

Champions: These are the premium customer base who stand at the top of the 3 pillars of RFM analysis, i.e., The customers who brought the most recent, most often, and spent heavily for the transaction. They can potentially be the first buyer of the new products and would help you to enhance the vitality by promoting the brand to its peak. You need to entertain these customers the most.

Potential Loyalists: These are the customers who made the transaction recently with average frequency and a decent amount of money. They never showed loyalty like the “champions” but can be driven with subscription offers, membership programmes, and upselling sessions. Power BI sessions help a business firm identify potential loyalists that give the business owner an area of opportunity to turn them into champion customers.

New Customers: This is the customer base that purchases with less frequency but spends a big amount on the transaction. The Power BI solution of atQor encourages the customer’s buying behaviour with the Customer Segmentation Dashboard and better RFM analysis. They can be involved with personalised reactivation campaigns to re-establish a firm connection with the business and promote excellent purchases.

At-Risk Customers: You are on the verge of losing these customers! They had made a big and frequent transaction in the past but haven’t made any purchase for a very long time. With personalized reactivation campaigns, another transaction can be encouraged, and these customers can be retained in the business. Power BI Solution of Microsoft Gold partner atQor is completely capable to do that.

A business aspiring for growth always understands the value of customers. So, Rather than overstretching the reach, It focuses on customer segmentation, retention, loyalty, and building consumer relations. It is better to segment the customers uniformly and understand the crowd’s nature, characteristics, and needs. This will enable the business owners to get their audiences involved in a proper marketing campaign and get what they need.

Being the Gold partner of Microsoft, atQor holds top-notch accountability to raise your business with the Power BI solution of RFM analysis. The exceptionally configured Customer Segmentation Dashboard allows you to dig down an understandable and visible perception of your customer and take a tactical decision accordingly.

So, It time to go beyond the traditional and manual framing of business. Cherry-picking or random selection of the right customer has been an obsolete practice and RFM analysis would be the new trend of the next decade.